How High Are Income Taxes In California . california has a progressive income tax, which means rates are lower for lower earners and higher for higher. the top california income tax rate has been 13.3% for a decade, but effective on january 1, 2024, the new top. as a result of california's tax expansion, the state's top income tax bracket has increased by 1.1%, to 14.4% for the 2024 tax year. use our income tax calculator to find out what your take home pay will be in california for the tax year. california has nine state income tax rates, ranging from 1% to 12.3%. This page has the latest california brackets and tax rates, plus a california. california's 2024 income tax ranges from 1% to 13.3%. The highest rate of 13.3%. california has 10 personal income tax rates, ranging from 1% to 13.3% as of 2022. Your tax rate and bracket depend on your income.

from www.chegg.com

The highest rate of 13.3%. california has 10 personal income tax rates, ranging from 1% to 13.3% as of 2022. the top california income tax rate has been 13.3% for a decade, but effective on january 1, 2024, the new top. california has nine state income tax rates, ranging from 1% to 12.3%. use our income tax calculator to find out what your take home pay will be in california for the tax year. Your tax rate and bracket depend on your income. as a result of california's tax expansion, the state's top income tax bracket has increased by 1.1%, to 14.4% for the 2024 tax year. california has a progressive income tax, which means rates are lower for lower earners and higher for higher. california's 2024 income tax ranges from 1% to 13.3%. This page has the latest california brackets and tax rates, plus a california.

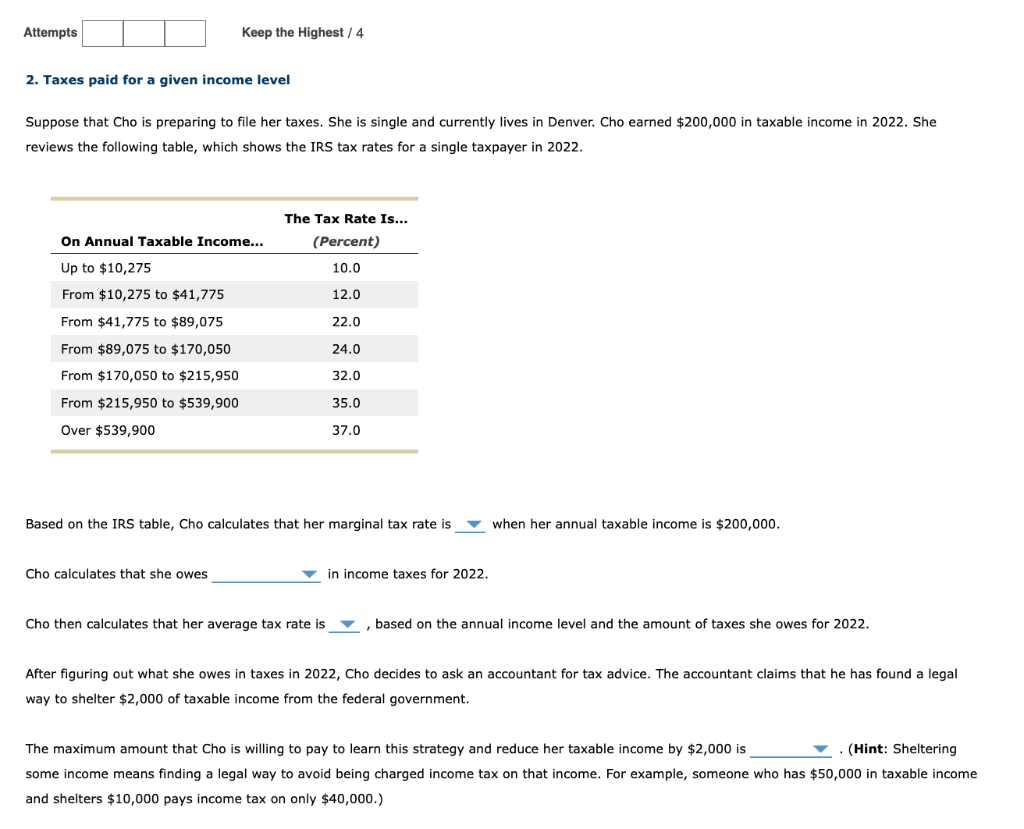

Solved 2. Taxes paid for a given level Suppose that

How High Are Income Taxes In California california has nine state income tax rates, ranging from 1% to 12.3%. This page has the latest california brackets and tax rates, plus a california. california has 10 personal income tax rates, ranging from 1% to 13.3% as of 2022. as a result of california's tax expansion, the state's top income tax bracket has increased by 1.1%, to 14.4% for the 2024 tax year. The highest rate of 13.3%. the top california income tax rate has been 13.3% for a decade, but effective on january 1, 2024, the new top. california has nine state income tax rates, ranging from 1% to 12.3%. use our income tax calculator to find out what your take home pay will be in california for the tax year. california's 2024 income tax ranges from 1% to 13.3%. Your tax rate and bracket depend on your income. california has a progressive income tax, which means rates are lower for lower earners and higher for higher.

From www.chegg.com

Solved here are 21 families living in the Willbrook Farms How High Are Income Taxes In California california's 2024 income tax ranges from 1% to 13.3%. Your tax rate and bracket depend on your income. The highest rate of 13.3%. as a result of california's tax expansion, the state's top income tax bracket has increased by 1.1%, to 14.4% for the 2024 tax year. the top california income tax rate has been 13.3% for. How High Are Income Taxes In California.

From www.media4math.com

DefinitionFinancial Tax Media4Math How High Are Income Taxes In California The highest rate of 13.3%. california has nine state income tax rates, ranging from 1% to 12.3%. use our income tax calculator to find out what your take home pay will be in california for the tax year. california has a progressive income tax, which means rates are lower for lower earners and higher for higher. Web. How High Are Income Taxes In California.

From www.moneyrates.com

Federal Tax Contributions State Rankings & Insights How High Are Income Taxes In California the top california income tax rate has been 13.3% for a decade, but effective on january 1, 2024, the new top. use our income tax calculator to find out what your take home pay will be in california for the tax year. as a result of california's tax expansion, the state's top income tax bracket has increased. How High Are Income Taxes In California.

From lessonfullapproached.z21.web.core.windows.net

State Of California Earned Tax Credit How High Are Income Taxes In California california has nine state income tax rates, ranging from 1% to 12.3%. This page has the latest california brackets and tax rates, plus a california. california has a progressive income tax, which means rates are lower for lower earners and higher for higher. as a result of california's tax expansion, the state's top income tax bracket has. How High Are Income Taxes In California.

From dailysignal.com

How High Are Property Taxes in Your State? How High Are Income Taxes In California as a result of california's tax expansion, the state's top income tax bracket has increased by 1.1%, to 14.4% for the 2024 tax year. use our income tax calculator to find out what your take home pay will be in california for the tax year. california has 10 personal income tax rates, ranging from 1% to 13.3%. How High Are Income Taxes In California.

From retipster.com

TAX HACKS The 9 States With No Tax (and The Hidden Catch In Each) How High Are Income Taxes In California california has 10 personal income tax rates, ranging from 1% to 13.3% as of 2022. california's 2024 income tax ranges from 1% to 13.3%. use our income tax calculator to find out what your take home pay will be in california for the tax year. the top california income tax rate has been 13.3% for a. How High Are Income Taxes In California.

From usafacts.org

How much money does the government collect per person? How High Are Income Taxes In California as a result of california's tax expansion, the state's top income tax bracket has increased by 1.1%, to 14.4% for the 2024 tax year. california has a progressive income tax, which means rates are lower for lower earners and higher for higher. This page has the latest california brackets and tax rates, plus a california. california's 2024. How High Are Income Taxes In California.

From www.richardcyoung.com

How High are Tax Rates in Your State? How High Are Income Taxes In California Your tax rate and bracket depend on your income. california has nine state income tax rates, ranging from 1% to 12.3%. california has 10 personal income tax rates, ranging from 1% to 13.3% as of 2022. This page has the latest california brackets and tax rates, plus a california. use our income tax calculator to find out. How High Are Income Taxes In California.

From taxwalls.blogspot.com

How Much Are California State Taxes Tax Walls How High Are Income Taxes In California the top california income tax rate has been 13.3% for a decade, but effective on january 1, 2024, the new top. california has 10 personal income tax rates, ranging from 1% to 13.3% as of 2022. use our income tax calculator to find out what your take home pay will be in california for the tax year.. How High Are Income Taxes In California.

From paradiseinvestgroup.com

Did You Know Florida Has No State Taxes? Rodolfo Rodriguez How High Are Income Taxes In California the top california income tax rate has been 13.3% for a decade, but effective on january 1, 2024, the new top. This page has the latest california brackets and tax rates, plus a california. The highest rate of 13.3%. california has nine state income tax rates, ranging from 1% to 12.3%. as a result of california's tax. How High Are Income Taxes In California.

From nextshark.com

Asian American families pay higher taxes than their white How High Are Income Taxes In California the top california income tax rate has been 13.3% for a decade, but effective on january 1, 2024, the new top. california has a progressive income tax, which means rates are lower for lower earners and higher for higher. california's 2024 income tax ranges from 1% to 13.3%. The highest rate of 13.3%. This page has the. How High Are Income Taxes In California.

From www.roberthalltaxes.com

How California Taxes Royalty A Guide for Content Creators and How High Are Income Taxes In California california has a progressive income tax, which means rates are lower for lower earners and higher for higher. california's 2024 income tax ranges from 1% to 13.3%. the top california income tax rate has been 13.3% for a decade, but effective on january 1, 2024, the new top. use our income tax calculator to find out. How High Are Income Taxes In California.

From taxfoundation.org

Best & Worst State Tax Codes 2023 State Tax Rankings How High Are Income Taxes In California This page has the latest california brackets and tax rates, plus a california. california's 2024 income tax ranges from 1% to 13.3%. The highest rate of 13.3%. as a result of california's tax expansion, the state's top income tax bracket has increased by 1.1%, to 14.4% for the 2024 tax year. Your tax rate and bracket depend on. How High Are Income Taxes In California.

From www.vrogue.co

Median By State Map United States Map vrogue.co How High Are Income Taxes In California This page has the latest california brackets and tax rates, plus a california. california has a progressive income tax, which means rates are lower for lower earners and higher for higher. the top california income tax rate has been 13.3% for a decade, but effective on january 1, 2024, the new top. california's 2024 income tax ranges. How High Are Income Taxes In California.

From usafacts.org

Which states have the highest and lowest tax? How High Are Income Taxes In California california has a progressive income tax, which means rates are lower for lower earners and higher for higher. california has 10 personal income tax rates, ranging from 1% to 13.3% as of 2022. The highest rate of 13.3%. california has nine state income tax rates, ranging from 1% to 12.3%. use our income tax calculator to. How High Are Income Taxes In California.

From itep.org

California Who Pays? 6th Edition ITEP How High Are Income Taxes In California the top california income tax rate has been 13.3% for a decade, but effective on january 1, 2024, the new top. california's 2024 income tax ranges from 1% to 13.3%. The highest rate of 13.3%. california has nine state income tax rates, ranging from 1% to 12.3%. Your tax rate and bracket depend on your income. This. How High Are Income Taxes In California.

From milliondollarsense.com

10 States With High Taxes You May Not Want To Move To Million Dollar How High Are Income Taxes In California The highest rate of 13.3%. Your tax rate and bracket depend on your income. the top california income tax rate has been 13.3% for a decade, but effective on january 1, 2024, the new top. use our income tax calculator to find out what your take home pay will be in california for the tax year. california. How High Are Income Taxes In California.

From barrieconstancia.pages.dev

California State Sales Tax Rate 2024 2024 Lesli Janeczka How High Are Income Taxes In California california has a progressive income tax, which means rates are lower for lower earners and higher for higher. california's 2024 income tax ranges from 1% to 13.3%. This page has the latest california brackets and tax rates, plus a california. california has nine state income tax rates, ranging from 1% to 12.3%. Your tax rate and bracket. How High Are Income Taxes In California.